The Paycheck Fairness Act of 2025 is a new legislative effort in the United States designed to narrow the persistent gender wage gap. While the Equal Pay Act of 1963 and Title VII of the Civil Rights Act of 1964 prohibit wage discrimination based on sex, wage disparities remain a significant issue.

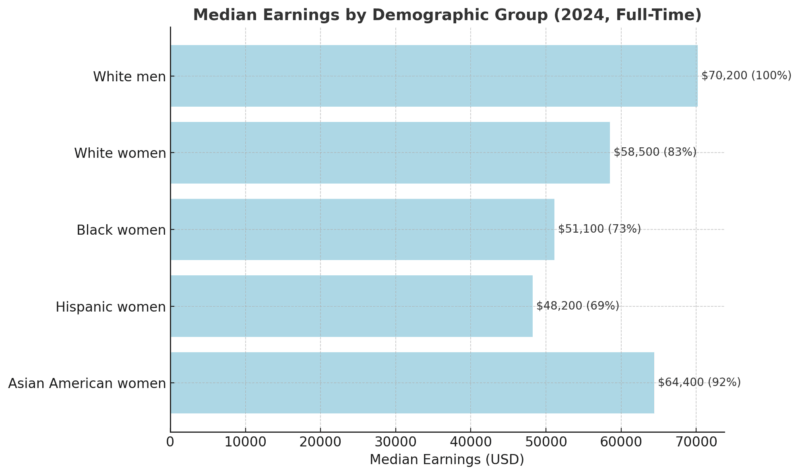

According to the U.S. Census Bureau (2024 data), women working full-time, year-round earn 82 cents for every dollar earned by men, with the gap even larger for women of color.

If enacted, the Paycheck Fairness Act would strengthen existing protections, close loopholes in prior laws, and create stronger enforcement mechanisms to ensure that workers receive equal pay for equal work.

The bill’s significance is not abstract – it could directly impact millions of families’ economic security, reduce poverty rates among women-headed households, and improve overall workforce participation.

Current State of the Gender Wage Gap

Despite decades of progress, wage inequality persists across nearly all industries and occupations.

Key Provisions of the Paycheck Fairness Act 2025

The Act builds on previous equal pay legislation but adds several new enforcement and transparency measures:

- Stronger Justification Requirements – Employers would have to prove that pay differences are based on factors such as education, training, or experience, not vague “business necessity” claims.

- Ban on Pay Secrecy – Employers would be prohibited from retaliating against workers who discuss wages with colleagues.

- Expanded Collective Remedies – Workers would be able to file class-action lawsuits more easily in cases of systemic pay discrimination.

- Increased Penalties – Employers found guilty of wage discrimination would face higher financial penalties, making violations less financially attractive.

- Training and Outreach – The Department of Labor would expand training programs for employers on fair pay practices.

Economic Impact of Closing the Gap

View this post on Instagram

Closing the gender wage gap is not only a matter of fairness-it also carries substantial economic benefits. Decades of research show that when women earn equal pay for equal work, the ripple effects extend far beyond individual households.

According to estimates from the Institute for Women’s Policy Research, eliminating the gap could inject as much as $512 billion annually into the U.S. economy. These gains would come from higher consumer spending power, increased contributions to retirement savings, and larger tax revenues that support public programs.

At the household level, the impact would be immediate and tangible. A typical two-income family would gain an additional $9,600 per year if women were compensated equally to men.

This difference could cover a year of child care, several months of mortgage payments, or the cost of higher education savings for children. For single mothers – who head nearly 15 million households across the U.S. – the stakes are even higher.

Equal pay would significantly reduce poverty rates, allowing these families to build financial security and stability rather than living paycheck to paycheck.

Closing the wage gap also has implications for the broader labor force. Women make up nearly 47% of the U.S. workforce, and when their earnings rise, labor participation and productivity often rise with it.

Economists argue that fairer wages would improve employee retention, reduce turnover costs for employers, and create a more motivated and loyal workforce. These improvements translate into measurable productivity gains that benefit both businesses and the economy at large.

Criticism and Opposition

Despite these potential benefits, the Paycheck Fairness Act of 2025 has not been without pushback. Business associations and employer advocacy groups argue that the bill may introduce new legal and financial risks for companies.

One of the central criticisms is that the Act’s expanded liability provisions could expose employers to costly lawsuits. Higher penalties for noncompliance, critics say, might encourage excessive litigation – even in cases where pay differences are legitimate and based on experience, education, or performance.

Another concern raised by opponents is the mandate for wage transparency. While pay disclosure is intended to empower employees and prevent hidden discrimination, some businesses worry that it could lead to workplace conflict if employees compare salaries without understanding the context behind them.

Critics suggest that such measures could create resentment and lower morale in certain settings.

A further line of opposition comes from those who caution against overregulation. They argue that requiring stricter proof for wage disparities could reduce flexibility for employers, especially in competitive industries where market-based pay adjustments are common.

Small businesses, in particular, warn that they may lack the administrative resources to comply with new federal requirements.

Beyond employer concerns, some opponents also contend that the wage gap is not solely the result of discrimination but is partially explained by occupational choices, career interruptions, and work-life balance decisions. Women, on average, are more likely to work in caregiving roles or in lower-paying industries, which contributes to wage differences.

However, research consistently shows that even after controlling for occupation, education, and experience, a significant portion of the gap remains unexplained – suggesting that structural barriers and biases continue to play a role.

Broader Social Context

The push for the Paycheck Fairness Act comes at a time when the U.S. labor market is undergoing rapid changes. Remote work, automation, and a shifting service economy all affect how wages are set.

The gender pay gap persists even in high-growth sectors such as technology, finance, and healthcare. For example:

| Industry | Male Median Earnings | Female Median Earnings | Gender Pay Gap |

| Tech | $92,000 | $74,000 | -20% |

| Healthcare | $68,500 | $55,000 | -20% |

| Finance | $95,000 | $78,000 | -18% |

These figures suggest that structural barriers, not just personal choices, keep the gap in place.

Conclusion

It’s 2025, and women are still earning less than men for the same work. Everyone deserves equal pay for equal work. Period.

This Equal Pay Day, I join my @demwomencaucus colleagues in fighting to pass the Paycheck Fairness Act and ensure women are paid fairly for the work they…

— Rep. Kim Schrier, M.D. (@RepKimSchrier) March 25, 2025

The Paycheck Fairness Act of 2025 represents the most comprehensive attempt in decades to address wage inequality in the U.S. By strengthening enforcement, banning pay secrecy, and creating clearer standards for fair pay, the bill aims to narrow a gap that continues to disadvantage women across industries.

Its goals align with provisions in teacher employment law that promote fairness and transparency in compensation for educators, a sector where pay equity remains an ongoing concern.

If passed, it could reshape workplace culture by normalizing wage transparency and holding employers accountable. More importantly, it would bring millions of women and families closer to financial security.

While debates will continue over its economic impact on employers, the Act stands as a direct response to a problem that previous laws have not solved.